AI is transforming banking by automating tasks like loan processing, fraud detection, and customer service. This shift helps banks cut costs, improve efficiency, and meet customer expectations for faster, personalized, and secure services. Here's a look at 10 AI tools designed to streamline banking processes:

- Meniga: Turns transaction data into insights for better financial management.

- Velmie: Simplifies operations with tools for loan processing and customer onboarding.

- Sopra Banking Software: Automates workflows like loan approvals and compliance reporting.

- nCino: Focuses on lending and deposit account automation, built on Salesforce.

- CR2: Provides tools for payment processing, account management, and fraud detection.

- Kasisto KAI: Conversational AI platform for customer service and compliance.

- Infosys Finacle: Automates workflows like risk assessment and regulatory reporting.

- Temenos AI: Manages customer service and risk with scalable AI solutions.

- Skan: Optimizes banking operations with automation tailored to growth.

- Itemize: Simplifies expense management by automating receipt handling.

Each tool offers unique features, integration options, and compliance capabilities to meet U.S. banking standards. Selecting the right tool depends on your bank's specific needs, regulatory requirements, and scalability goals.

How to Choose AI Tools for Banking

Picking the right AI tools for banking isn't just about finding the most advanced technology - it’s about ensuring they align with your bank’s operations, regulations, and long-term goals. A poor choice can lead to compliance issues, security breaches, and operational headaches. Below are key factors to guide your decision-making process.

Regulatory compliance should be your top priority. Any AI solution must adhere to established standards like SOC 2 Type II and PCI DSS, as well as data protection laws such as GDPR and CCPA. Look for vendors with a clear track record of compliance and thorough documentation to back it up.

Integration capabilities are crucial, especially if your bank uses legacy systems. The tools you select should work seamlessly with platforms like FIS, Jack Henry, or Temenos. Check if the vendor offers pre-built connectors and confirm the timeline for integration, along with the availability of technical support during the process.

Scalability is another critical factor, particularly as transaction volumes grow. Ensure the tool can handle increased workloads without performance issues. Ask for benchmarks and examples of large-scale implementations to assess its capacity.

Vendor reputation and financial stability matter significantly in the banking industry. Research the vendor’s funding, leadership team, and client retention rates. Established vendors are generally more reliable and better equipped to meet the unique demands of banking.

Data security and privacy must be airtight. Verify that the vendor uses strong encryption methods, follows recognized security frameworks, and conducts regular penetration testing. Additionally, review their incident response plan and cyber insurance policies to gauge their readiness for potential threats.

Performance verification goes beyond vendor claims. Request case studies that include measurable metrics, such as processing speeds, error rate reductions, or customer satisfaction improvements. Speaking with current clients can provide valuable insights into real-world performance.

Total cost of ownership includes more than just the upfront licensing fees. Factor in costs for implementation, training, support, and any necessary infrastructure upgrades. For transaction-based pricing models, ask for detailed scenarios to ensure there are no unexpected expenses.

Support and training can vary widely between vendors. Confirm that the vendor offers thorough training and reliable 24/7 support. Check whether training is included in the package and verify response times for support requests.

Finally, conduct a proof-of-concept using actual banking data. This step helps identify any integration or performance issues early on. Establish clear success criteria and evaluate the results objectively. By applying these considerations, you can confidently select AI tools that enhance your banking operations without compromising security or efficiency.

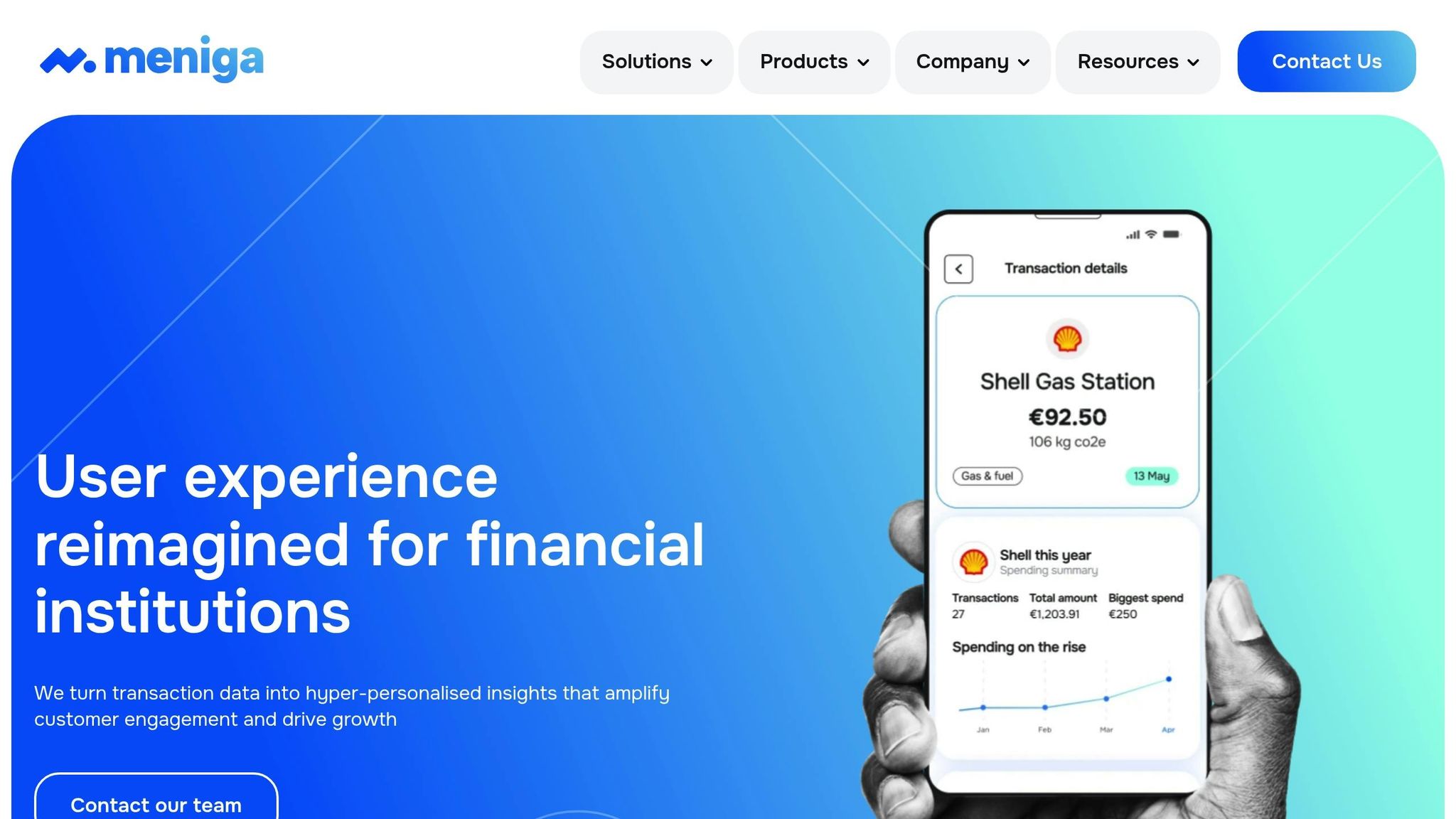

1. Meniga

Meniga is a platform designed to help users manage their finances by turning transaction data into actionable insights through the use of AI.

Key Features

Meniga stands out with its AI-powered categorization engine, which organizes transactions, identifies spending habits, and fine-tunes recommendations using machine learning. Beyond its functionality, the platform emphasizes security and strict adherence to regulations.

Regulatory Compliance and Data Security

Meniga is built with a strong focus on data protection and regulatory compliance. Its privacy-by-design framework ensures sensitive information stays within the bank's control, supported by robust security measures that undergo regular validation.

Integration with Banking Systems

The platform is designed to work effortlessly with existing banking infrastructure. Its API-first architecture and pre-built connectors make it easy to integrate into core banking systems and digital channels without disrupting operations.

Scalability and Adaptability

Thanks to its cloud-native architecture, Meniga can scale to meet the needs of both small community banks and large financial institutions. It handles varying transaction volumes efficiently and offers customizable AI models and user interfaces to adapt to specific requirements.

Tailored for U.S. Banking Standards

Meniga is aligned with U.S. banking practices, integrating seamlessly with major payment networks. It also provides tools like detailed reporting and audit trails to meet regulatory requirements in the United States.

2. Velmie

Velmie uses AI to simplify banking operations and improve how financial services are delivered. It’s built to help banks modernize their systems while maintaining strict security and compliance standards.

With Velmie, banks can automate repetitive tasks like loan processing, risk evaluation, and customer onboarding. Plus, the platform’s integration options make it easy to incorporate into existing workflows.

Integration with Existing Banking Infrastructure

Velmie’s microservices architecture lets banks seamlessly integrate AI modules into their current systems using pre-built APIs. This modular setup means banks can introduce tools step by step - starting with areas like loan origination or customer verification - without having to replace their entire system.

The platform supports both cloud-based and on-premises setups. Banks can choose to implement features like automated document processing, AI-powered chatbots, or predictive analytics for managing risks.

Scalability and Flexibility

Built on cloud-native infrastructure, Velmie scales effortlessly with transaction volumes and adapts as its AI learns over time. This ensures smooth performance, whether for small community banks or large financial institutions.

Additionally, Velmie offers customization options for workflows, user interfaces, and automation rules, giving banks the ability to tailor the platform to their specific needs and compliance requirements.

Support for U.S. Banking Standards

Velmie is designed to meet U.S. regulatory standards by maintaining detailed audit trails and generating compliance reports. It supports U.S. dollar transactions and integrates with major payment networks. Its fraud detection tools also help reduce risks and ensure compliance with anti-money laundering regulations.

3. Sopra Banking Software

Sopra Banking Software is designed to streamline core banking operations while maintaining high levels of security. It focuses on modernizing traditional banking processes through automation, covering everything from customer service to risk management.

With Sopra Banking Software, banks can automate tasks like loan approvals, simplify compliance reporting, and improve customer interactions using AI-driven insights. Its strength lies in handling complex banking workflows while ensuring data protection and meeting regulatory standards. The platform is built with a strong focus on compliance and security to safeguard banking operations.

Regulatory Compliance and Data Security

This software is built to meet the strict regulatory requirements of the banking industry. It includes integrated tools for monitoring and reporting, automatically creating audit trails for all transactions. These detailed logs ensure financial institutions meet their compliance obligations.

To protect sensitive data, the platform uses multi-layered encryption and advanced threat detection. Real-time monitoring capabilities help identify suspicious activities and potential security threats. Additionally, banks can customize security features to align with their specific compliance needs.

Integration with Existing Banking Infrastructure

Sopra Banking Software is designed with an API-first architecture, making it easy to connect with existing systems. Banks can integrate it with their core banking platforms, payment processors, and customer relationship management systems using pre-built connectors.

The integration process often involves linking specific modules - such as fraud detection, customer onboarding, or loan processing - into current workflows. This modular approach allows banks to implement AI-driven automation gradually, testing and adjusting each component before expanding its use.

Scalability and Flexibility

Thanks to its cloud-native design, the platform can scale automatically to handle fluctuating transaction volumes. This ensures smooth performance during busy times, like month-end reporting or high-trading periods.

Sopra Banking Software also offers configurable workflows to suit a wide range of banking operations. Whether it’s processing mortgage applications, managing credit cards, or handling commercial loans, banks can adjust automation rules, approval thresholds, and reporting formats to fit their unique needs.

Support for U.S. Banking Standards

The platform is fully equipped to meet the demands of U.S. banking standards. It supports U.S. dollar transactions and integrates seamlessly with major American payment networks, such as ACH, wire transfers, and card processing systems.

Anti-money laundering (AML) and Know Your Customer (KYC) processes are automated using AI algorithms that screen transactions and customer data against regulatory watchlists. The software also generates reports formatted to meet federal standards and submission requirements, ensuring compliance with U.S. banking authorities.

4. nCino

nCino is a cloud-based platform tailored for the banking industry, focusing on automating processes like commercial lending and deposit account openings. Built on Salesforce's infrastructure, it combines customer relationship management (CRM) with tools for loan origination and portfolio management, offering a comprehensive solution for financial institutions.

The platform simplifies lending workflows by automating tasks such as credit analysis, document collection, and approval routing. It also keeps detailed audit trails for compliance. With AI-driven risk assessment tools, nCino enables banks to make quicker and more informed lending decisions by analyzing borrower data and market trends in real time.

Integration with Existing Banking Infrastructure

One of nCino's strengths lies in its ability to integrate seamlessly with existing banking systems, thanks to its Salesforce-native architecture. The platform includes over 200 pre-built integrations, connecting with core banking systems, credit bureaus, and third-party financial services.

Using RESTful APIs and SOAP, banks can link nCino to their loan servicing, accounting, and reporting systems. For document management, nCino integrates with tools like DocuSign for electronic signatures and supports document imaging systems. This connectivity allows banks to enhance their operations with AI-powered automation while maintaining relationships with their current vendors.

Scalability and Flexibility

nCino's cloud-based infrastructure is designed to scale effortlessly, handling high transaction volumes during busy periods. For example, during peak lending seasons, it can process thousands of applications at once without compromising performance.

The platform also offers customizable workflows, enabling banks to tailor processes to their specific needs. Community banks, for instance, can set up straightforward workflows for small business loans, while larger institutions may implement more complex, multi-step processes for commercial real estate financing involving multiple teams and external appraisers.

nCino accommodates both relationship-focused models often favored by community banks and transaction-driven approaches typical of larger lenders. Banks can adjust user interfaces, reporting dashboards, and automation settings to align with their operational goals and regulatory requirements.

Support for U.S. Banking Standards

nCino is specifically designed to meet the needs of U.S. financial institutions. It supports both federal and state lending regulations, automates compliance reporting, and manages U.S. dollar transactions with accurate formatting and interest calculations. Additionally, it integrates with major networks such as FedWire and ACH. The platform also includes automated KYC/AML screening, ensuring borrowers are checked against OFAC and other federal watchlists for compliance purposes.

5. CR2

CR2 provides AI-powered digital banking tools designed to simplify processes while meeting strict compliance and security standards for financial institutions. With a focus on automation, the platform supports key banking operations like payment processing, account management, and customer onboarding.

Some standout features of CR2 include AI-driven transaction monitoring, automated compliance reporting, and real-time fraud detection. Its machine learning algorithms analyze transaction patterns to spot unusual activities, minimizing false alarms. Meanwhile, automated workflows take care of routine tasks such as opening accounts and processing loans.

CR2 is built with an API-first approach, making it easy to integrate with both legacy systems and modern banking platforms. Pre-built connectors allow banks to link CR2 to existing systems, payment networks, and third-party tools without disrupting their current operations. This enables a smooth transition to more efficient digital solutions.

The platform adheres to stringent U.S. banking regulations, offering SOC 2 compliance, PCI DSS certification, and support for federal reporting requirements. CR2 also employs multi-layered encryption and automated audit trails to safeguard data and ensure regulatory compliance.

With its seamless integration capabilities and strong focus on security, CR2 is well-positioned to adapt to the ever-changing demands of digital banking.

6. Kasisto KAI

Kasisto KAI is a conversational AI platform tailored for financial institutions, addressing the unique challenges of banking compliance and security with precision. Powered by its proprietary KAIgentic technology, it’s built to navigate the intricate demands of the financial sector.

Regulatory Compliance and Data Security

Kasisto KAI is equipped with a comprehensive compliance framework that includes fraud detection, audit logging, policy enforcement, and regulatory reporting. By leveraging intelligent pre- and post-processing, the platform fine-tunes agent behavior while identifying anomalies. These capabilities are further backed by U.S. Patent 10,440,003, which highlights its advanced security measures. It’s a system designed to align effortlessly with U.S. regulatory requirements.

Support for U.S. Banking Standards

Kasisto KAI simplifies adherence to federal standards by generating compliance reports and audit trails that meet stringent banking regulations.

sbb-itb-212c9ea

7. Infosys Finacle

Infosys Finacle is a cutting-edge digital banking platform designed to modernize traditional banking by automating processes like loan origination, customer onboarding, and regulatory reporting. With its AI-driven tools, Finacle simplifies complex workflows, enhances efficiency, and ensures compliance - an essential aspect of today’s banking landscape.

The platform leverages machine learning to optimize key banking operations, including risk assessment and fraud detection. Its AI-powered analytics engine delivers real-time insights, helping financial institutions make informed decisions quickly.

Integration with Existing Banking Infrastructure

One of Finacle's standout features is its ability to integrate seamlessly with existing banking systems. Thanks to its API-first architecture, the platform connects effortlessly with core banking systems, payment networks, and third-party services without requiring a complete overhaul of current systems.

Its microservices-based design allows banks to adopt Finacle's AI capabilities gradually. This incremental approach minimizes risks and operational disruptions while enabling institutions to add new functionalities at their own pace. Whether banks prefer on-premise or cloud deployment, Finacle offers flexible integration options tailored to fit their technology stack and regulatory needs.

Scalability and Flexibility

Finacle’s architecture is built to handle the demands of modern banking. It can process millions of transactions daily while maintaining consistent performance across various banking channels. This scalability ensures that banks can grow alongside customer demands and transaction volumes.

The platform’s modular design gives banks the freedom to customize automation workflows. Institutions can adjust risk parameters, prioritize specific processes, or refine customer interaction flows - all without requiring deep technical expertise.

Finacle also supports multi-tenancy, enabling large banking groups to manage multiple subsidiaries or business units through a single platform. This feature simplifies maintenance and reduces costs, making it especially appealing for large organizations. Paired with its focus on regulatory compliance, Finacle is well-suited to meet the needs of U.S. banks.

Support for U.S. Banking Standards

Finacle is equipped with compliance tools that align with Federal Reserve regulations and other U.S. banking standards. It automates the generation of regulatory reports and maintains detailed audit trails for all automated processes, ensuring transparency and accountability.

The platform supports key U.S. banking functions, including USD formatting, ACH processing, wire transfers, and check-clearing services. Its compliance engine is continuously updated to reflect changes in banking regulations, ensuring that processes remain aligned with current standards.

Finacle’s risk management capabilities include Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols tailored for the U.S. market. It can automatically flag suspicious transactions and generate required regulatory reports, reducing the manual workload for compliance teams while enhancing overall security and accuracy.

8. Temenos AI

Temenos AI simplifies banking operations by automating key processes. It’s built to handle various tasks, including improving customer service, managing risks, and automating routine decisions.

Integration with Existing Banking Systems

Temenos AI connects effortlessly with core banking systems using standard APIs. This setup allows banks to link essential fintech tools and payment processors without the need for a complete system overhaul. By doing so, it helps banks enhance their digital capabilities while maintaining operational stability.

Scalability and Efficiency

Temenos AI is designed to adjust computing resources as needed, making it suitable for both small-scale and large-scale operations. Its support for multi-tenant environments ensures that large financial institutions can address diverse automation requirements with ease.

Compliance with Regulations

Temenos AI aligns with U.S. banking regulations, simplifying tasks like data management and regulatory reporting to ensure compliance.

9. Skan

Scalability and Flexibility

Skan is designed to grow alongside U.S. banking institutions, adjusting effortlessly to the needs of organizations both large and small. As banks expand or refine their operations, Skan keeps pace, ensuring efficiency and smooth integration with the ever-changing demands of the modern banking landscape.

10. Itemize

Itemize takes the hassle out of expense management by automating the process of handling receipts and categorizing expenses. This reduces the need for manual data entry and helps simplify workflows, saving time and effort.

At this time, specific details about its technical methods and data security protocols haven't been shared.

With that, we wrap up our look at AI tools that are transforming banking process automation.

Tool Comparison Table

Here's a quick reference guide to the AI tools mentioned earlier. While this table provides a snapshot, it’s worth exploring each tool further for more detailed insights.

| Tool |

|---|

| Meniga |

| Velmie |

| Sopra Banking Software |

| nCino |

| CR2 |

| Kasisto KAI |

| Infosys Finacle |

| Temenos AI |

| Skan |

| Itemize |

Keep in mind, this is just a starting point. For deeper insights into features, pricing, and implementation details, check out the vendors' official websites or reach out to them directly. This overview is meant to help guide your exploration of these tools and others covered in the upcoming sections.

Find More AI Tools

The ten tools mentioned earlier are just the tip of the iceberg when it comes to AI solutions. The fintech world is constantly evolving, with new tools and technologies emerging at a rapid pace.

If you’re looking to explore beyond these ten tools, AI Apps is a fantastic resource. This platform offers access to over 1,000 AI tools tailored to banking and other industries. It’s a curated collection that includes everything from specialized financial solutions to automation tools designed to streamline banking operations.

What makes AI Apps stand out is its advanced filtering options. You can sort tools by category, sub-category, and pricing, making it much easier to find solutions that align with your institution's compliance requirements and integration needs. Instead of sifting through irrelevant options, banking professionals can zero in on the tools that matter most.

Another helpful feature is the ability to compare tools side by side. This allows you to quickly evaluate features, pricing, and use cases, which is especially useful when deciding between niche banking software and more general automation tools that could be adapted for financial services.

AI Apps also highlights the newest advancements in AI-driven banking solutions, ensuring you stay informed about emerging technologies that could address specific challenges or give your institution a competitive edge.

For professionals venturing into AI implementation, AI Apps serves as a comprehensive starting point. Its verification process ensures that every listed tool meets quality standards, giving you confidence in the solutions you’re considering for your institution's critical financial processes.

Conclusion

AI-powered banking automation has become a necessity in today’s financial landscape. The ten tools we’ve discussed highlight how artificial intelligence can revolutionize everything from customer service to compliance monitoring, delivering measurable improvements in efficiency and cost savings.

With benefits like faster transactions, reduced operational costs, and enhanced customer experiences, these tools are helping financial institutions remain competitive in an increasingly digital world where customer expectations are higher than ever.

Whether you’re a community bank exploring AI chatbots like Kasisto KAI to enhance customer service or a large institution aiming for full-scale automation with platforms like Temenos AI, there’s a solution to match your needs and budget. Start by identifying the manual processes that consume the most time and resources, and consider piloting one of these tools to see immediate results. Many platforms even offer trial periods to help you gauge their effectiveness.

For those seeking more options, AI Apps provides access to over 1,000 AI tools with advanced filters, making it easier to find specialized solutions tailored to your unique challenges.

The digital transformation in banking is moving faster than ever, and AI automation is no longer just an advantage - it’s essential. The real question isn’t whether to adopt these technologies, but which ones will bring the most value to your operations.

FAQs

How can I choose the right AI tool to automate my bank’s processes?

To choose the right AI tool for your bank, begin by clearly outlining your automation goals. Whether you're aiming to boost customer service, strengthen fraud detection, or simplify workflows, knowing your objectives will guide your decision. Next, assess your current infrastructure to confirm it can support AI technologies and look for tools that integrate smoothly with your existing systems.

Select solutions that match your bank's strategic priorities and offer user-friendly interfaces, scalability to grow with your needs, and robust governance features. Keeping these factors in mind can pave the way for a seamless rollout and help you achieve greater operational efficiency over time.

What risks come with using AI tools in banking, and how can they be managed?

AI tools in banking bring along certain risks, including cybersecurity vulnerabilities, data privacy issues, bias in decision-making, and regulatory non-compliance. If left unchecked, these challenges could undermine trust, compromise security, and disrupt operations.

To tackle these risks effectively, banks need to adopt a proactive approach. This includes implementing robust cybersecurity measures, creating AI governance frameworks to promote fairness and transparency, and performing regular audits to evaluate AI systems. Additionally, continuous monitoring and comprehensive staff training play a vital role in addressing emerging threats and ensuring adherence to industry regulations.

How do AI tools help banks comply with regulatory standards?

AI tools play a crucial role in helping banks stay on top of regulatory requirements by automating essential compliance tasks like data collection, analysis, and reporting. This not only boosts efficiency but also reduces the likelihood of errors, ensuring more precise outcomes. With machine learning models in the mix, banks can keep an eye on transactions, spot potential violations, and safeguard sensitive information, all while staying aligned with privacy laws.

On top of that, AI systems help banks stay informed about changing regulations by monitoring updates and offering actionable insights. They also support real-time risk evaluations, flag potential compliance issues, and produce detailed reports. This makes it much simpler for financial institutions to manage the often-complicated world of regulatory demands.